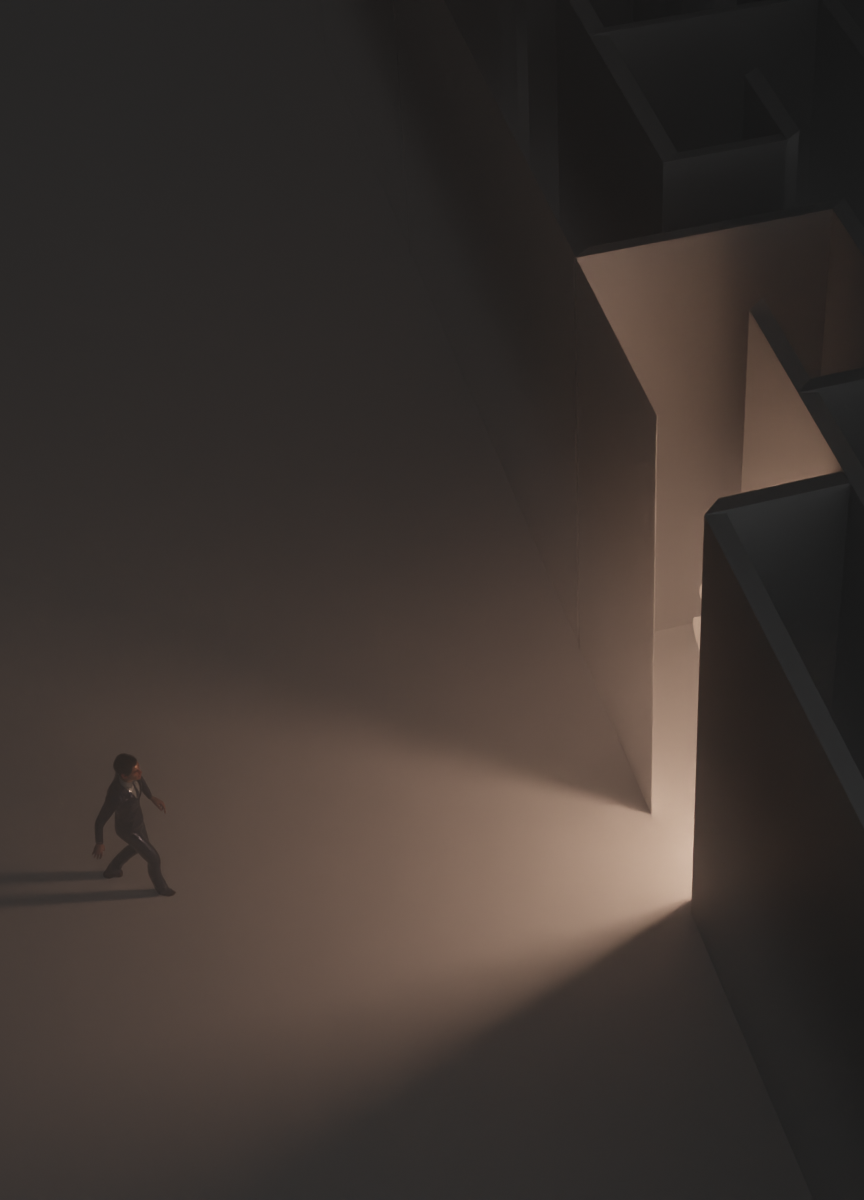

Navigating the Maze

Navigating generational wealth is like navigating a complex maze – probably one you’ve never seen before. It’s easy to find yourself alone, confused, a little intimidated and claustrophobic. You can’t tell what’s behind each turn.

Is it a dead end?

A U-turn?

What is lurking around the corner?

Are you walking around in circles just wasting time?

What opportunities are you missing by choosing one path over another?

The maze represents the difference between where you are and where your legacy is. It’s the path from the life you have today to the life you want the most for yourself and for the most important people and causes in your world. You may have hints of what’s possible, but you don’t know how to achieve it. You’re not sure how to measure the tradeoffs, and how to get from here to there.

Maybe you saw your parents work their way through their own maze. Maybe they stumbled around a bit, and maybe they found a guide to help them through. Maybe they made some progress but they got stuck along the way, never realizing the full potential of their legacy. Maybe they sacrificed important relationships on the way to their destination. Maybe they spent more fretful nights than they really needed to – maybe they still are.

Your maze is different. In fact, every maze is different. They all have the same traps, but the solution through the maze is as unique as the hero in the middle. If you’re like most successful entrepreneurs, you may not even realize you’re lost in a maze. Until you wake up one day to find yourself in the middle of a labyrinth that grew up around you.

What traps are lurking in the maze? In the context of legacy wealth, they are legion.

Avoidable Taxes. We’re reminded every April (and in most cases, at least every quarter) the tangible cost of financial success. Navigating the tax code effectively is essential to reducing the erosion of your wealth from avoidable taxes.

Opportunity Costs. Many entrepreneurs don’t think about protecting wealth until after a big exit, or after their balance sheet reflects their success. The most effective time to plan is when values are low, before the velocity of your wealth accelerates. There are always planning options available after the wealth is built, but there’s natural leverage in planning when values and markets are soft.

Custodial and Jurisdictional Risk. Uncertain regulatory environments and exchanges masquerading as custodians can expose your wealth to unlimited loss. Chasing “yield” without fully understanding counterparty or other risks often ends very badly for investors.

Creditors. It’s easy to think of a potential creditor as some stranger on the street. In reality, most creditors first start out as friends, business partners, lovers, or spouses. They’re often someone you sought out, connected with, built a friendship, and entered into an intimate relationship. You were going to build the next best thing, take over the world together, or maybe raise a family. It’s much more effective to protect wealth BEFORE problems arise. Mitigating creditor risk is an essential part of navigating the maze.

Unprepared Heirs. At what point does it make sense to drop hundreds of thousands of dollars – or millions of dollars – into a kid’s lap? (The correct answer is probably, “Never.”) Strategic inheritance planning helps preserve family wealth while helping the most important people in your life flourish and become the best possible version of themselves. That doesn’t mean hiding wealth from your loved ones, but it does mean limiting the opportunities for hard-fought wealth to be squandered by poor decisions, bad luck, unhealthy lifestyles, or immature relationships.

There are many more risks – as well as innumerable opportunities – you’ll encounter as you navigate your maze. We built Bespoke to help successful entrepreneurs and families navigate the maze of risk and opportunity in a constantly changing world.

Let us be your guide.

The information in this blog post is intended for general educational purposes only and should not be construed as legal advice.

View All Resources